What does it mean to credit a source

Yous've applied for a credit card and were approved (congrats!), but that doesn't mean yous have unlimited spending power.

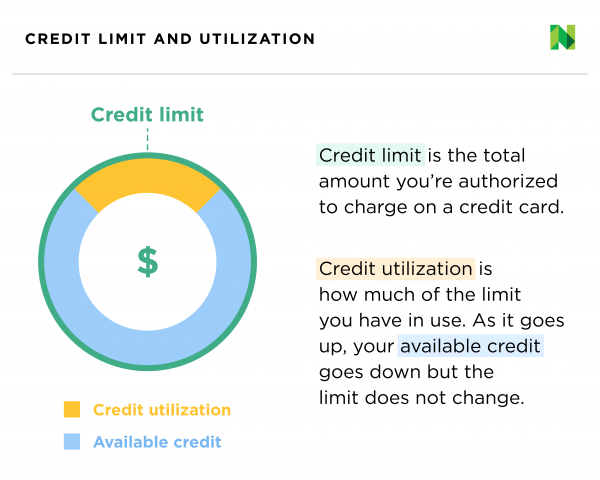

It'southward important to know your bill of fare's credit limit, which is the maximum amount you tin spend on your bill of fare. Also important: your available credit, which is the limit minus your current rest. These numbers both play a big role in your credit score.

What is a credit limit and where tin you discover information technology?

Your credit limit is the total amount of charges you lot're authorized to make on a credit carte du jour. When you lot apply for a credit bill of fare, the lender will examine elements of your fiscal history and decide your credit limit, or the maximum corporeality you're immune to borrow.

If y'all're unsure where to discover your credit limit on a new or existing credit card, y'all tin endeavour looking in a few places, including your online account or monthly statement.

What factors decide your credit limit?

-

Your payment history , or the record showing whether you've paid your bills on time and if you've missed any payments.

-

Your credit score , a number from 300 to 850 that indicates your creditworthiness to potential lenders.

-

Your income, which is one way lenders assess your ability to pay back the money you're lent.

-

Your credit utilization, or how much of your electric current credit limits you're using.

What is available credit?

Your available credit is the amount that's left once you lot subtract your residuum from your credit limit on any given card. For instance, say your credit limit is $ane,000 and yous paid the residuum in full final billing cycle. If yous've spent $300 this billing bike, y'all nevertheless have $700 in available credit before y'all hitting your limit. Only it's of import to note that "maxing out" your credit menu is not recommended, because it will harm your score.

If you lot pay off your credit card in total, the available credit resets back to $i,000. Only if you sometimes carry a balance on the bill of fare, go on your credit limit in heed then that you don't suffer credit score damage or get into debt too difficult to recover from.

Credit limit and your credit score

Knowing your credit limit is important because credit utilization — how much of your credit limits you lot're using — is a major factor in your credit score.

There'due south no downside to keeping your credit utilization ratio low ; in fact, the best credit scores tend to go to people using very petty of their limits. But if you apply also much of your credit, you could be viewed by potential lenders equally a higher risk, which could complicate the procedure of applying for things like a car loan or home loan.

A proficient guideline is the 30% dominion: Use no more than than thirty% of your credit limit to go along your debt-to-credit ratio strong. Staying nether 10% is fifty-fifty meliorate.

In a real-life budget, the 30% rule works like this: If you have a carte with a $1,000 credit limit, it'south best not to have more than a $300 rest at any time. One way to keep the balance below this threshold is to make smaller payments throughout the month.

Pros and cons of increasing your credit limit

Credit limits don't e'er stay the same across the life of your business relationship since your finances will also modify over time. Information technology's smart to assess whether information technology'south a expert time to ask for a credit limit increase . You lot might exist primed to ask for a credit increase if you've recently gotten a enhance, take good credit or have a proven rails record of making payments on fourth dimension.

Pros of a higher credit limit:

-

It offers more flexibility in your budget.

-

It volition shrink your overall credit utilization ratio if you lot don't stack up a residual. And lower utilization will help your credit score. Computing that ratio before you start the conversation is a adept idea.

Cons of a college credit limit:

-

It allows you to spend more and potentially rack upward debt that is hard to pay off.

-

The credit cheque often used to confirm eligibility could ding your credit score. Inquire your card issuer if information technology will crash-land up your limit without a hard inquiry on your credit.

If you make up one's mind to move frontwards with the request after weighing the benefits and potential pitfalls, you can request a credit increase through a few avenues . The easiest fashion is to simply ask, usually through your online banking portal or by phone.

What if y'all spend more than than your credit limit?

If y'all brand a charge that puts y'all over your approved credit limit, your credit carte may be declined. If yous exceed your credit limit frequently, your lender may take actions including canceling the menu, cutting rewards or lowering your limit.

And you'll likely be doing not bad damage to your credit score.

Keep up with your credit score

We'll let you know when your score changes, and provide free insights for means to keep edifice.

Why does your credit limit matter?

Your credit limits are a key slice of your financial portfolio. Keeping your spending at 30% of your credit limits or below is one strategy to improve your credit. Knowing your credit limits — and planning how much of them to use — is also a way you tin avoid overspending and going into debt.

There are other ways to manage your credit to brand sure it'south healthy. Paying your bills on time is essential to keeping your credit score potent, and setting up automatic payments is ane strategy that can aid. Mixing up the kinds of credit you accept, paying attention to the average age of your accounts (a long record of responsible credit usage is a expert thing), and spacing out your credit applications are proficient means to keep your credit healthy.

Want nerdy knowledge that'southward personalized to your money? Bring all your coin into one view, and get tailored insights to make the nearly of it. Larn more.

Source: https://www.nerdwallet.com/article/finance/what-is-credit-limit

0 Response to "What does it mean to credit a source"

Post a Comment